Car title loans are the perfect alternative for those who are in need of emergency cash and who have a less than admirable credit history. Embassy Loans of Florida, for example, can complete a vehicle title loan in as little as an hour and solve your financial emergency. Here is how it works.

Unlike traditional forms of borrowing, a car title loan does not require background checks, credit history checks, and the other mounds of paperwork involved with a conventional loan. If a borrower has a vehicle with a clear title, he or she can complete a title loan. The vehicle is offered as collateral as opposed to an unsecured loan from a bank or credit union where approval is based upon one’s ability to repay a loan. The fact that the vehicle is used as collateral allows the lender to forgo any background or credit checks. This speeds up the process.

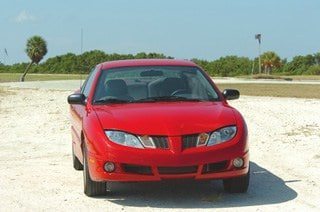

Typically, a title loan borrower can complete an application in just a few minutes. At Embassy Loans, for example, borrowers can complete the application online or in person. The borrower will need to produce the vehicle, its title, and a form of photo identification. Once completed, the vehicle will need to be inspected. Embassy Loans has over 20 convenient locations around the state of Florida for potential borrowers. The car is matched to the title and then appraised for value.

With the title and value confirmed, the loan can be completed and a borrower can have access to their cash, many times, the same day. Without lengthy credit checks and employment verifications, car title loans are the perfect solution to those who suffer from bad credit and are in need of funds quickly.

When you have a financial emergency and bad credit looms, a title loan is the solution. Lenders do not need borrowers with great credit. They do not even need borrowers who are employed as long as they have a vehicle with a clear title. In these cases, car title loans are the best option.