- Get your credit scores. Make sure you know what your credit scores are before you start talking to dealers. There may be errors on your credit report that you can fix to improve your scores.

- Make sure you have a down payment. With bad credit, you are already a credit risk. You can reduce some of that risk by putting money down.

- Make a file with all your important documents. When you start meeting with dealers and their finance people, having all your documentation ready will show that you capable of taking on the responsibility of a car payment. The file should contain things like your Social Security number, proof of employment, proof of income, and proof of residency.

- Have a co-signer as backup. In some cases, you may need someone to co-sign with you on the loan agreement. Since you have bad credit, the lender may see you as a credit risk. A parent, relative, or friend with good credit who would be willing to co-sign for you makes you less of a risk. If it comes to it, have someone lined up who would be prepared to co-sign your loan.

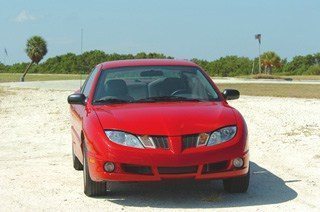

Having bad credit can be a burden at times and make things like buying a car difficult. If you can obtain a used car loan, repaying it can help to improve your credit score and rebuild your credit history. Once the car is paid off, you can also use it as collateral for a car title loan. Embassy Loans has helped thousands of borrowers access cash for a variety of reasons. Car title loans are short-term loans that are ideal for those with bad credit or those who need cash quickly. Borrowers offer a vehicle as collateral for the loan, and the processing is typically completed within a day or two. Loans are usually for a few hundred to a few thousand dollars which you can repay within 12 to 14 months.